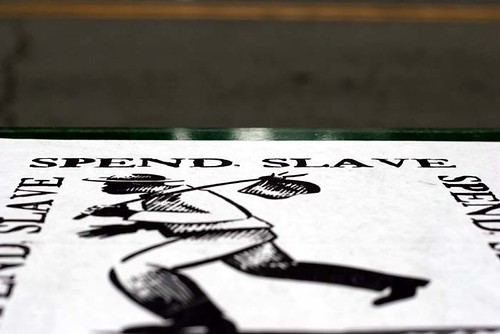

Do you find yourself spending more than you earn? Yet when you look back, you find that you actually spent that money on something that you could have done without. Worse still, you spent that money on someone you did not necessarily have to please.

How can you avoid spending the money that you do not have, thus reducing incidences of overspending? Read on to find out.

10 Examples how you can overspend unnecessarily

A fresh graduate decides to buy an imported Japanese car. As a result, he uses up 50% of his salary for the monthly installments, car maintenance and petrol. He is then left with another 50% for his other commitments and expenses.

1. A fresh graduate decides to buy an imported Japanese car. As a result, he uses up 50% of his salary for the monthly installments, car maintenance and petrol. He is then left with another 50% for his other commitments and expenses.

2. You impulsively swipe your credit card to pay for the latest Apple laptop you always had an eye on. At the end of the month, you find that you are unable to pay the amount due.

3. Your colleague just moved into a semi-detached house. You sold your entire investment portfolio and existing apartment, took up a bigger mortgage to buy the house next to his.

4. An office lady uses her entire month’s salary to buy the Louis Vuitton hand bag, just because her colleague shows off one to her.

5. You want your boy friend to propose only if he presents you with a Tiffany’s ring.

6. A father took up a personal loan of RM10,000 so that he can take his family for a vacation to Australia. Although he did not need to take this holiday given his financial situation, he did so because his neighbour just came back from New Zealand.

7. Have a breast implant to impress the man you are interested in although he is not interested.

8. You bought an expensive set of home theatre system. However, you rarely watch any DVD at home since you are too busy at work. It is just to impress your friends who visit your house.

9. Bought a Rolex watch during your trip to Switzerland just because your boss said that it was a great investment.

10. You spent lots of money on your wedding ceremony and serve the best food, although all your wife wanted was a honeymoon in Europe.

What is the money you don’t have?

- Credit card - If you can’t afford to pay it in full when the charges is due, it is the “future money”, not “current money” that you already have

- Mortgage - you use the bank’s money to buy a house and stay in it, as long as you are able to pay it back to the financier.

- Personal debt - getting a personal loan to spend on something is the stupidest thing to do.

- Loan shark - those who don’t have credit card, without proper documents to borrow from banks will look for “favours” from loan shark.

- Easy installment plan to purchase consumer product

What are the things that you don’t necessarily need?

Car, a plush house, gadgets and other things that do not fall within your budget. The rule of thumb is to spend less than one third of your income on these items.

Who are the people you don’t like?

- Friends, colleagues and relatives who like to show off,

- those who look down on you,

- those who slap you on the back.

You can have a thousand reasons to hate and dislike somebody, but you don’t have to hurt your wallet.

Have you ever done something like that?

We sometimes, unknowingly, spend money on instant gratification, only to regret much later. We sometimes also give in to our temptations to buy things that we don’t have much use for or things that are impractical.

The next time, before you decide to blow your cash on something, try to think about how many hours of toiling at work that money equates to. This does not mean you need to stinge on everything that you wish to buy. Only buy something if you really need it.

Although this may sound like easy advice, we always end up faltering. We spend more than that we can earn and in the end, find ourselves struggling to make ends meet.

-Credit to KCL.